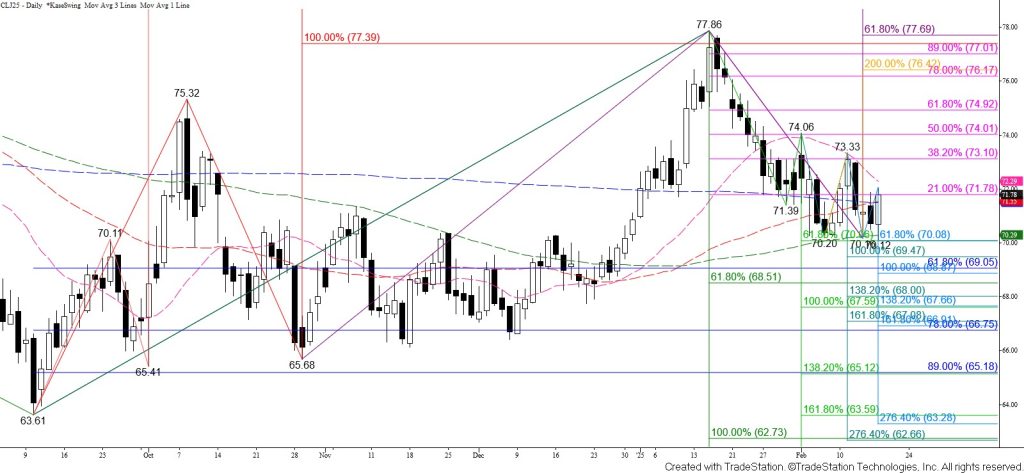

WTI Crude Oil Technical Analysis and Short-Term Forecast

April WTI crude oil tested and held the $70.2 area again on a closing basis. A triple bottom (one could argue for a quadruple bottom) has formed around $70.2. Furthermore, today’s bullish engulfing line and close back above the 50- and 200-day moving averages implies that a larger test of resistance will take place tomorrow. Closing above $72.1 will call for $72.8 and possibly a test of the $73.3 confirmation point of the triple bottom.

At this point, it has become clear that the breakout points for the next significant move are $73.3 and $70.2. Today’s bullish engulfing line dampens the odds for a close below key support at $70.2 to negate the triple bottom and open the way for $69.5 and lower.