WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

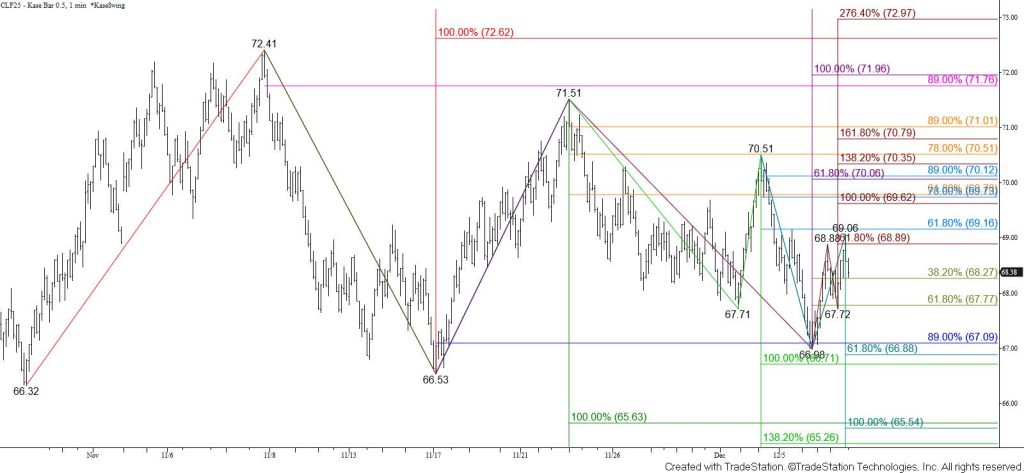

WTI crude oil continues to trade in a narrowing range. Prices were poised to break lower out of the range coming into the week, but the move down stalled again and prices have risen for the first two days of the week. There is evidence that a larger test of resistance within the range might occur, so this is a tight call. Even so, the move up from $66.98 is likely a correction and the outlook continues to lean bearish and favors an eventual break lower out of the range.

Today’s long-legged doji reflects near-term uncertainty and warns that the corrective move up from $66.98 might already be complete. Taking out the 62 percent retracement of the rise from $66.98 and the $67.72 swing low will invalidate the wave up from $66.98 that suggests a larger test of resistance might occur. This will also call for a test of a confluent target at $66.8, a close below which will open the way for a break lower out of the range to test $65.6 and lower.

That said, the wave up from $66.98 met its $68.9 smaller than (0.618) target today. This wave warns that a test of its $69.6 equal to (1.00) target might take place first. To reach $69.6 WTI crude oil must overcome the 62 percent retracement of the decline from $70.51 at $69.2. The $69.6 level, if met, is expected to hold. Overcoming this would call for a test of key near-term resistance at $70.1. This is the smaller than target of the wave up from $66.53 and connects to $72.0 and higher.