WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

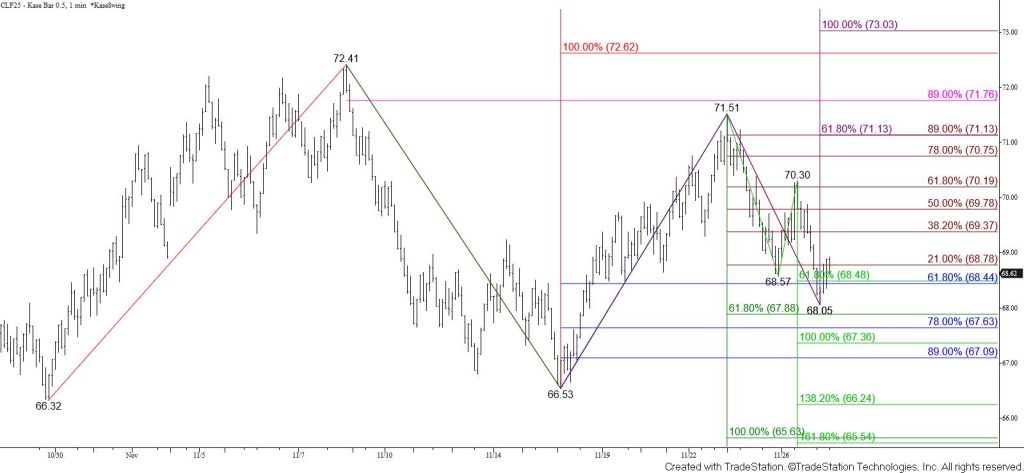

January WTI crude oil continues to trade in a weeks-long range. Each time WTI crude oil has been poised to break higher or lower out of the range a reversal has taken place. This looks to be the case again this week. The move up from the $66.4 double bottom was poised to break higher upon a close above the $72.6 equal to (1.00) target of the wave up from $66.32. However, Monday’s bearish engulfing line and today’s move below the 62 percent retracement of the rise from $66.53 and smaller than (0.618) target of the wave down from $71.51 around $68.4 imply that another test of the bottom of the range will probably take place in the coming days.

The wave down from $71.51 calls for a test of its $67.4 equal to target. This will push prices below the $67.9 smaller than target of the wave down from $72.41. Settling below $67.9 will clear the way for an eventual test of this wave’s $65.6 equal to target, which is also the larger than (1.618) target of the wave down from $71.51. The connection to $65.6 is also made through the $66.3 intermediate (1.382) target of the wave down from $71.51, which is in line with the $66.4 double bottom. Therefore, closing below $67.9 will put WTI crude oil in a position to break lower out of the trading range.

That said, the $68.4 target held on a closing basis and prices have risen from the $68.05 swing low this afternoon. The move up from $68.05 is likely a simple correction and is expected to hold the 38 percent retracement from $71.51 at $69.4. Overcoming this would call for a test of the 62 percent retracement and $70.3 swing high. Overcoming $70.3 would invalidate the wave down from $71.51 that calls for $67.4 and lower. This would also call for a test of key near-term resistance and the smaller than target of the wave up from $66.53 at $71.1. Settling above $71.1 would shift the odds in favor of WTI crude oil attempting to break higher out of the range again by settling above $72.8, a threshold that this split between the equal to target of the waves up from $66.32 and $66.53 and above the confirmation point of the $66.4 double bottom.