Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

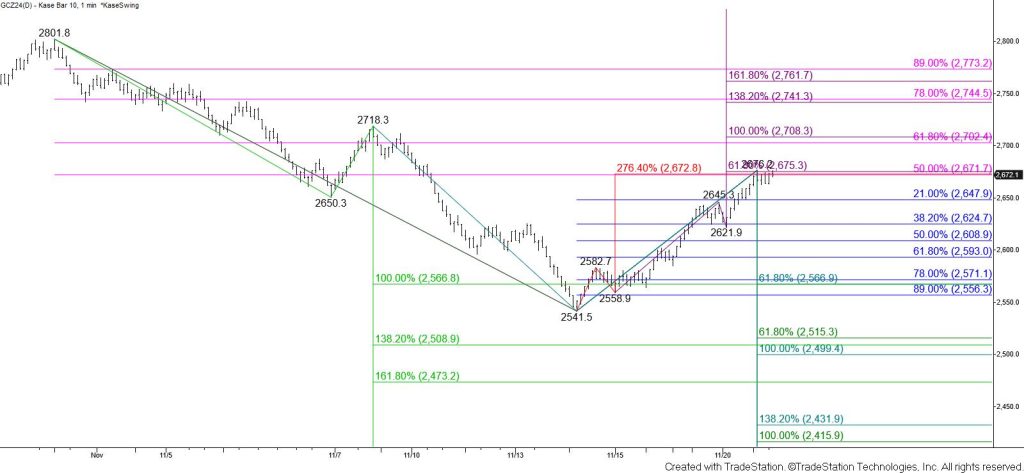

December gold rose to challenge the $2672 XC (2.764) projection of the wave up from $2541.5 and the 50 percent retracement of the decline from $2801.8. This is a potential stalling point and there is a reasonable chance for a test of support before the move up extends. Even so, a move down ahead of the weekend will likely be a simple correction because the wave up from $2558.9 also met its $2675 smaller than (0.618) target today. This wave calls for a test of its $2705 equal to (1.00) target, which is in line with the 62 percent retracement from $2801.8. Settling above $2705 will strongly suggest that gold’s corrective pullback from $2801.8 is complete.

Should a correction take place first, look for initial support at $2650 to hold. Falling below this would call for a test of key near-term support at $2625. A normal correction of the rise from $2541.5 will hold $2625. Settling below this will warn that the move up is failing and shift the near-term odds in favor of gold testing the 62 percent retracement at $2593.