Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

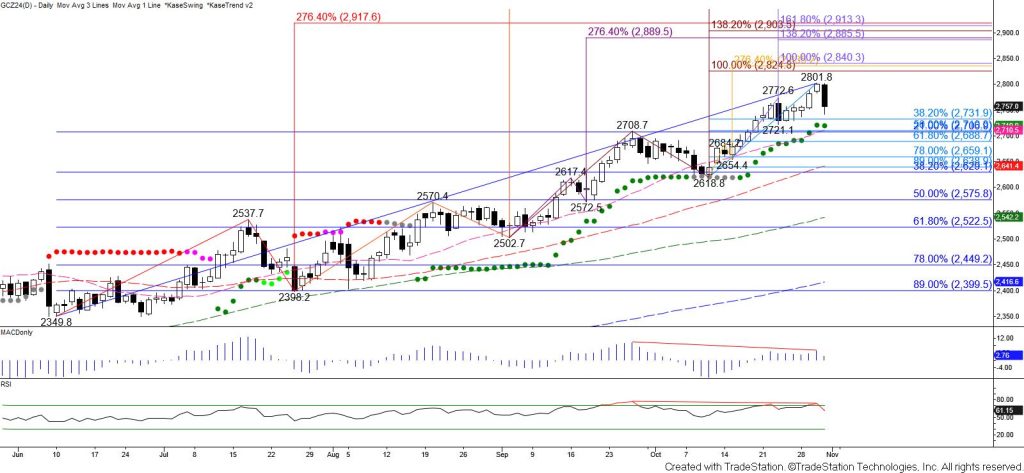

Gold’s move up has been due for a solid test of support for some time now. Weekly momentum has been overbought and daily momentum moved back into overbought territory on the RSI earlier in the week. The bullish trend is intact, but today’s decline and confirmation of bearish daily MACD and RSI divergences suggest that a correction might finally be underway.

The challenge is that a similar pattern that formed on October 23 failed to lead to a meaningful correction.

Regardless, today’s move down was bearish for the near-term outlook, and a test of the 38 percent retracement of the rise from $2349.8 at $2732 is expected. Closing below this will call for the 50 percent retracement from $2618.8 and the 21 percent retracement of the rise from $2349.8 at $2710 to be challenged. This is the most important target because closing below $2710 will take out the 20-day moving average and shift the Kase Trend indicator to bearish (which it has not been since August 16).

That said, prices rose a bit late this afternoon. Should gold overcome today’s $2774 midpoint look for another test of key resistance at $2802. Settling above $2802 will negate the bearish patterns and signals that formed today and put the near-term odds back in favor of gold rising to $2823 and higher.