WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

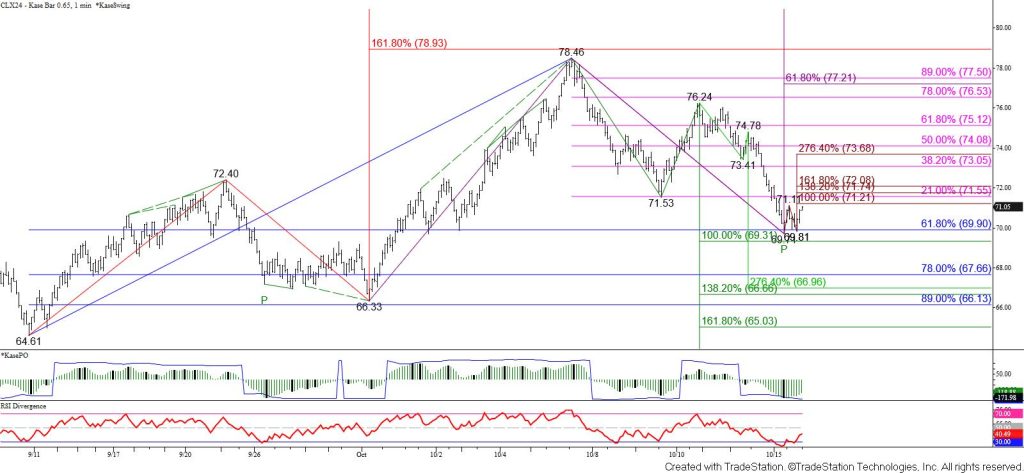

WTI crude oil fell to test the 62 percent retracement of the rise from $64.61 at $69.9 and nearly fulfilled the $69.3 equal to (1.00) target of the wave down from $78.46. Both targets held on a closing basis and the move up from $69.71 formed a wave that should challenge at least $71.2 and possibly its $72.1 larger than (1.618) target first.

The move up is likely a correction though. The near-term outlook remains bearish and another test of $69.9 and likely $69.3 is expected. Settling below $69.3 will confirm a bearish outlook and strongly suggests that the move up from $64.61 is complete. This will also clear open the way for a test of $67.7 and then the $66.8 intermediate (1.382) target of the wave down from $78.46 in the coming days.

That said, oversold RSI and KasePO PeakOut signals on the $0.65 Kase Bar chart warn that the test of resistance could lead to a bullish reversal. Overcoming $72.1 would call for a test of key near-term resistance at $73.1. A normal correction of the move down will hold $73.1 because this is the 38 percent retracement of the decline from $78.46. Closing above this would shift the near-term odds in favor of challenging $73.9 and possibly the 62 percent retracement at $75.1.