Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

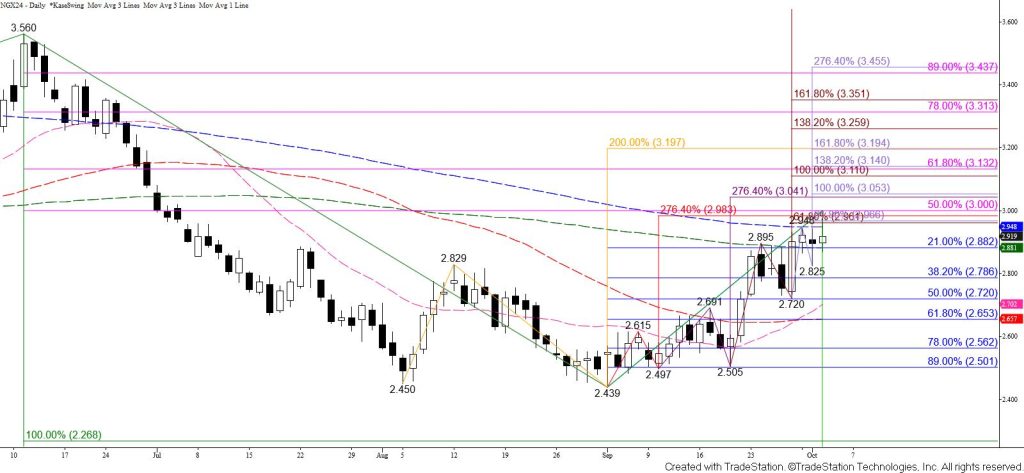

Natural gas rose to challenge the psychologically important $3.00 level today. This is also a confluent wave projection and retracement level on the November chart that sits just above the 200-day moving average. The outlook for natural gas is bullish and closing above $3.00 will call for $3.05, $3.12, and eventually the $3.20 target of a confirmed double bottom.

That said, this is a tight call for the next few days. The move up is due for a correction and $3.00 is the most probable point from which such a move will take place. Monday’s evening star setup, Tuesday’s long-legged doji, and today’s shooting star also warn that a correction will take place before the move up extends. Settling below $2.83 will complete these patterns and call for a test of the 38 percent retracement of the rise from $2.439 at $2.79. A simple correction will hold $2.79. Settling below this will call for the $2.75 confirmation point of the bearish daily candlesticks to be challenged. Closing below $2.75 is doubtful but would suggest that a bearish reversal and much more significant test of support is underway.