Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

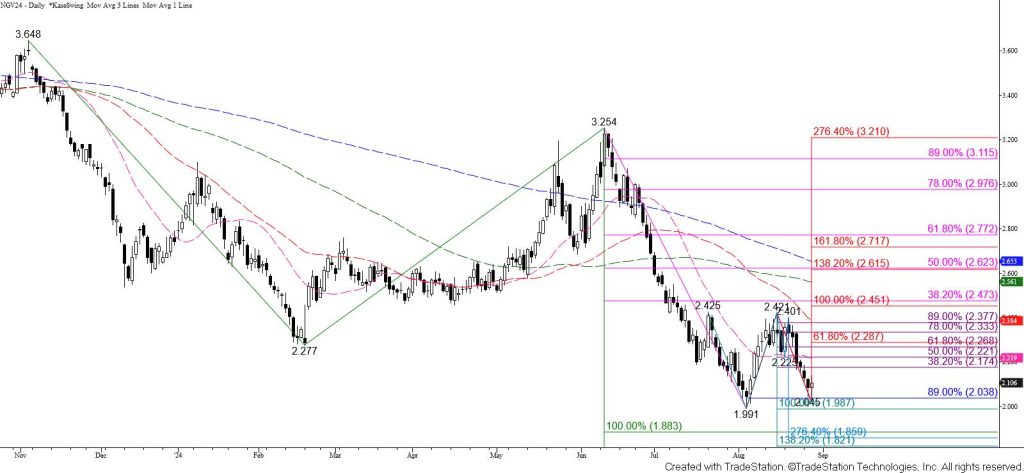

October natural gas recaptured a bearish outlook for the near-term after settling below the 78 percent retracement of the rise from $1.991 and negating a potential inverse head and shoulders pattern. The 89 percent retracement at $2.04 has held though, and today’s long-legged doji warns that another test of resistance might take place before prices challenge $1.99 and lower.

The wave down from $2.425 calls for a test of its $1.99 equal to (1.00) target after prices settled below the $2.15 smaller than (0.618) target on Monday. Closing below $2.04 will significantly increase the odds for a test of $1.99, which is in line with the $1.991 contract low. Settling below $1.99 may be a challenge given its proximity to the psychologically important $2.00 level but would open the way for the $1.88 equal to target of the wave down from $3.648 to finally be fulfilled.

Nonetheless, support at $2.04 has been resilient for the past two days. Furthermore, today’s long-legged doji and the intra-day wave up from $2.021 suggest a test of $2.14 and even $2.18 might take place first. The $2.18 level is key resistance for the near-term because it is in line with the 38 percent retracement of the decline from $2.421. Settling above $2.14 would warn that the move down is failing and call for tests of $2.23 and a near-term bullish decision point at $2.28 that connects to $2.45 and higher.