WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

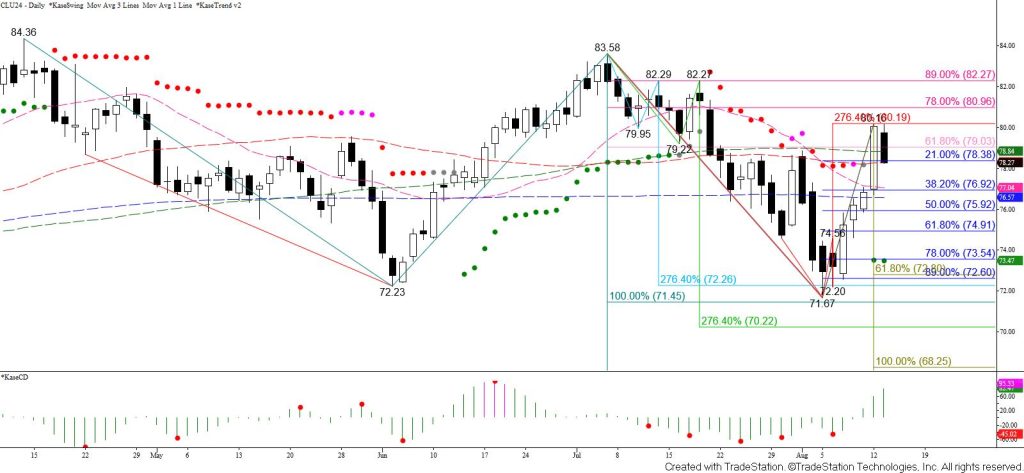

WTI crude oil rallied on Monday and overcame the $78.88 swing high and settled above the 62 percent retracement of the decline from $83.58 and the bullish threshold of the daily Kase Trend indicator. This was bullish for the outlook of WTI crude oil in the coming weeks. However, the $80.2 XC (2.764) projection of the first wave up from $71.67 held and a small intra-day double top formed around $80.16. The double top was confirmed and prices settled below the pattern’s $78.5 target, Monday’s midpoint, and the 21 percent retracement of the rise from $71.67 on Tuesday.

The pullback from $80.16 is likely a correction. However, the wave down from $80.16 is poised to test its $77.8 XC (2.764) projection early Wednesday. Falling below $77.8 will call for a test of key support at $76.9. This is in line with Monday’s open and the 38 percent retracement of the rise from $71.67. Based on the current wave formation down from $80.16, settling below $76.9 is doubtful. Such a move would warn that the move up is failing again.

Should $77.8 hold and prices rise above Tuesday’s $79.0 midpoint, which is also currently the 38 percent retracement from $80.16, look for another test of $80.2. Closing above $80.2 will confirm a bullish outlook for the coming days and clear the way for the $81.1 smaller than (0.618) target of the wave up from $69.16 to be challenged.