Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

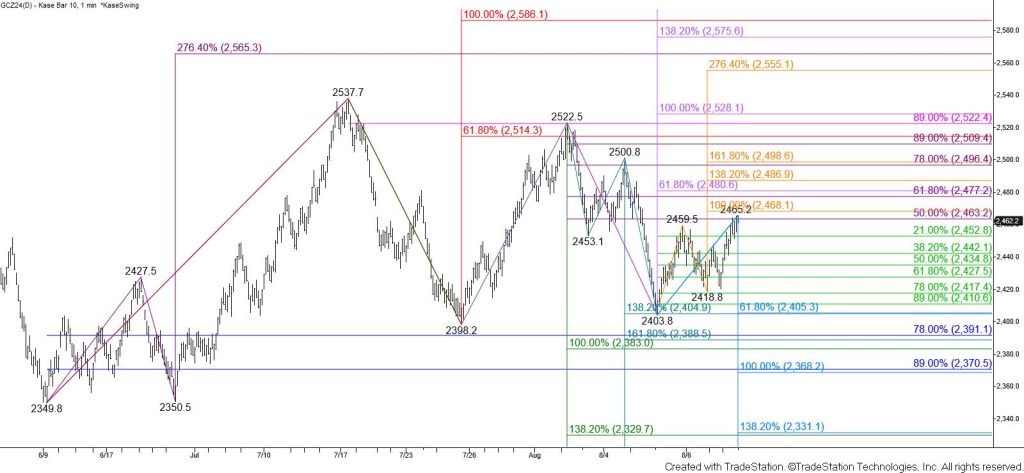

December gold rose to challenge resistance at $2465 today. This level is in line with the equal to (1.00) target of the wave up from $2403.8 and the 50 percent retracement from $2522.5. The move up could still prove to be a correction given the wave down from $2537.7 favors a test of its $2386 equal to target. However, today’s move up confirmed Wednesday’s morning star. Therefore, tomorrow’s outlook is bullish.

The next major objective is $2477. This target is split between the 62 percent retracement from $2537.7 and the smaller than (0.618) target of the wave up from $2398.2. Settling above $2477 would suggest that the move down is complete and open the way for another test of the $2514 smaller than target of the wave up from $2349.8 and then the $2528 equal to target of the wave up from $2398.2.

Should the $2465 level continue to hold look for initial support at $2442. Falling below this would call for a test of $2428 and possibly key near-term support at $2405. Closing below $2405 would shift the near-term odds back in favor of fulfilling the $2386 equal to target of the wave down from $2537.7.