Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

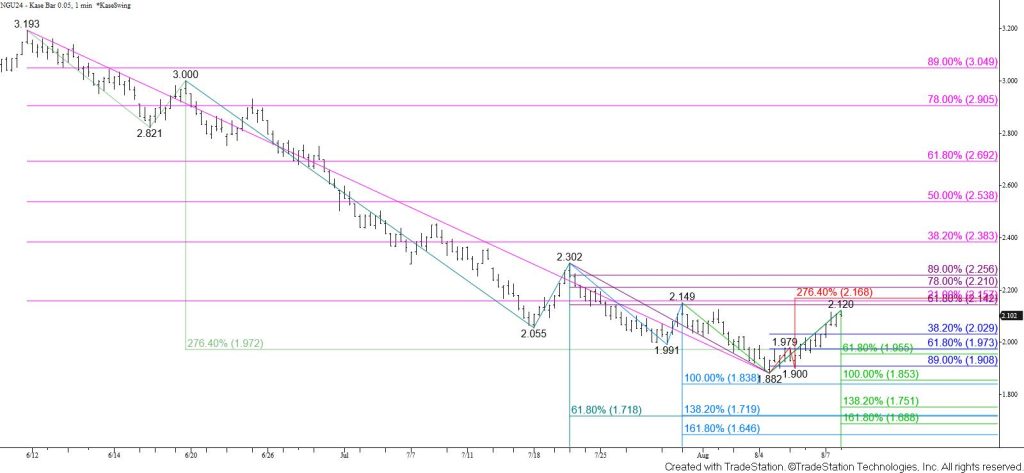

Natural gas continued to rise as called for in Tuesday’s update and confirmed Friday’s morning star setup and Monday’s hammer. Daily bullish KaseCD, RSI, and Stochastic divergences were also confirmed. These patterns and signals call for a larger test of resistance and warn that a bullish reversal may be underway.

The move up is now poised to challenge a highly confluent and key target at $2.16. This objective is split around the XC (2.764) projection of the wave up from $1.882, the 62 percent retracement from $2.302, and the 21 percent retracement from $3.193. The $2.16 target also sits above the $2.149 swing high and is in line with the bullish threshold of the daily Kase Trend indicator. Settling above $2.16 might be a challenge without another test of support first but would open the way for $2.19, $2.24, and $2.28 in the coming days.

Nevertheless, the move up could still prove to be another simple correction. This is because the waves down from $3.570 and $2.302 still favor a test of $1.83. Should natural gas turn lower before overcoming $2.16 look for support at $2.07 and $2.03. Falling below $2.03 will call for a test of key near-term support at $1.97.