WTI Crude Oil Technical Analysis and Short-Term Forecast

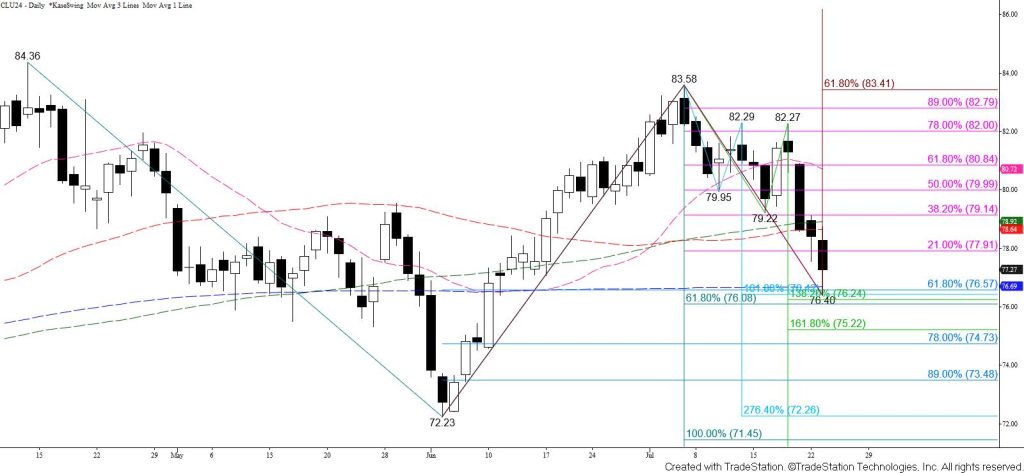

WTI crude oil fell to challenge the 200-day moving average and 62 percent retracement of the rise from $72.23. This support at $76.6 held on a closing basis, but the subsequent move up from $76.40 is likely a simple correction. Another test of $76.6 is anticipated. Taking out $76.6 will call for a test of the $76.1 smaller than (0.618) target of the wave down from $84.36. Settling below $76.1 will confirm a bearish outlook for the coming days, and likely the next few weeks, opening the way for $75.2 and lower.

There are no bullish patterns or signals on the daily chart that call for a reversal. The $76.6 and $76.1 targets are crucial though and this is an area where the move down could stall. Should WTI crude oil overcome initial resistance at $77.7 look for a test of $78.6 and possibly key near-term resistance at $79.1. The $79.1 level is the 38 percent retracement of the decline from $83.58. Therefore, settling above this would warn that the move down is failing.