WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

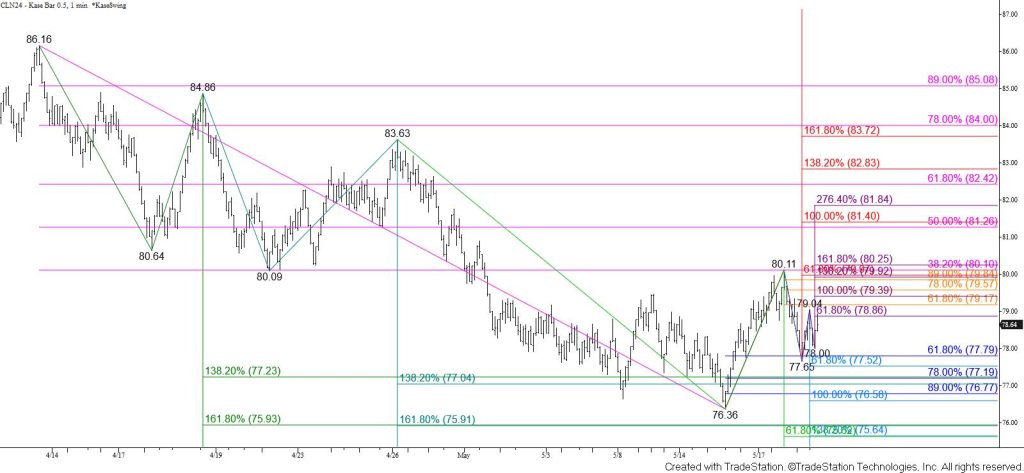

WTI crude oil tested and held the 38 percent retracement of the decline from $86.16 at $80.1 on Monday. The subsequent pullback from $80.11 challenged the 62 percent retracement of the rise from $76.36 at $77.8 and 100- and 200-day moving averages today. This level also held on a closing basis. Even so, holding $80.1 and pulling back to test $77.8 warns that the move up from $76.36 is a completed correction.

Falling below $78.0 will invalidate the wave up from $77.65 which shows potential to test $79.4 early tomorrow. This will also open the way for a test of the $77.5 smaller than (0.618) target of the wave down from $80.11. Taking out $77.5 will clear the way for a move below the $77.1 intermediate (1.382) targets of the waves down from $86.16 and $84.86 to challenge $76.7 and then a long-term bearish decision point at $75.8.

This is still a tight call for the next few days though. This is because the wave up from $77.65 fulfilled its $78.9 smaller than target. Waves that meet the smaller than target typically extend to at least the equal to (1.00) target, in this case, $79.4. Therefore, there is a good chance for a test of $79.4 first. For the move down to extend as expected, $79.4 should hold. Overcoming $79.4 would call for a test of a highly confluent level and key resistance at $80.1. This is now the smaller than target of the wave up from $76.36, a close above which will shift the near-term odds in favor of WTI crude oil testing $80.9 and then this wave’s $81.4 equal to target in the coming days.