Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

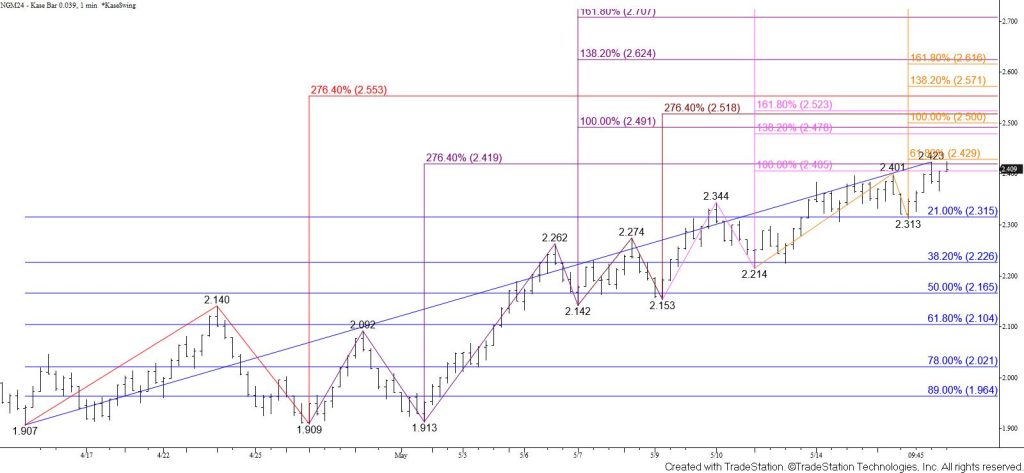

June natural gas continued to rise as called for today. The move up negated Tuesday’s bearish Harami and tested the XC (2.764) projection of the subwave up from $1.907. Most importantly, prices settled above the $2.380 target of a rectangle that broke higher on May 6 and the last major swing high at $2.392. The move up is now poised to challenge targets around the psychologically and historically important $2.50 level in the coming days. Closing above the $2.43 smaller than (0.618) target of the wave up from $2.214 will clear the way for $2.48, $2.52, and eventually a test of the $2.55 XC (2.764) projection of the primary wave up from $1.907.

That said, the daily Stochastic is overbought and the daily RSI and KasePO are nearing overbought territory. No bearish patterns or confirmed signals call for a reversal, but these factors warn that a test of support might take place soon. Moreover, there is a small wave down from $2.423 that projects to $2.39 at the smaller than target. Falling below this will call for a test of $2.36 and possibly key near-term support at $2.32. Settling below $2.32 would not mean that the move up has failed but would put the near-term odds in favor of a deeper test of support where $2.23 is the next most important threshold.