WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

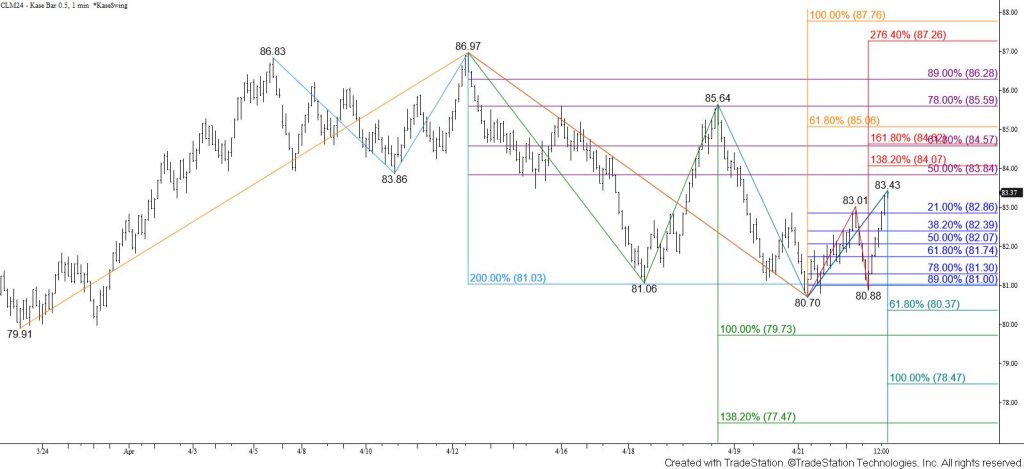

June WTI crude oil retested the $81.0 target of a confirmed double top that formed around $86.9 today. This has been resilient support for the past few days and held on a closing basis again. The wave up from $80.7 extended and settled the day above its equal to (1.00) target and the 38 percent retracement of the decline from $86.97. WTI also settled just below the $83.5 completion point of bullish daily hammers and an inverted hammer that formed Thursday, Friday, and Monday. The wave up from $80.7 is now poised to overcome $83.5 to fulfill its $84.0 intermediate (1.382) target and possibly the $84.7 larger than (1.618) target. The $84.7 target is most important because it is also in line with the 62 percent retracement from $86.97 and the confirmation point of the bullish daily candlesticks. Settling above $84.7 will strongly imply that the corrective pullback from $86.97 is complete and that WTI crude oil will work its way to a new uptrend high in the coming days.

Today’s rise was bullish for the near-term outlook. However, while the $85.64 swing high holds the wave down from $86.97 still has potential to extend to its $79.7 equal to (1.00) target. This is because this wave took out its smaller than (0.618) target a few days ago. Should prices turn lower early tomorrow look for initial support at $82.4. Falling below this will call for $81.7 and possibly another attempt to take out key support at $81.0. Settling below $81.0 will clear the way for the $79.7 threshold to be fulfilled.