Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

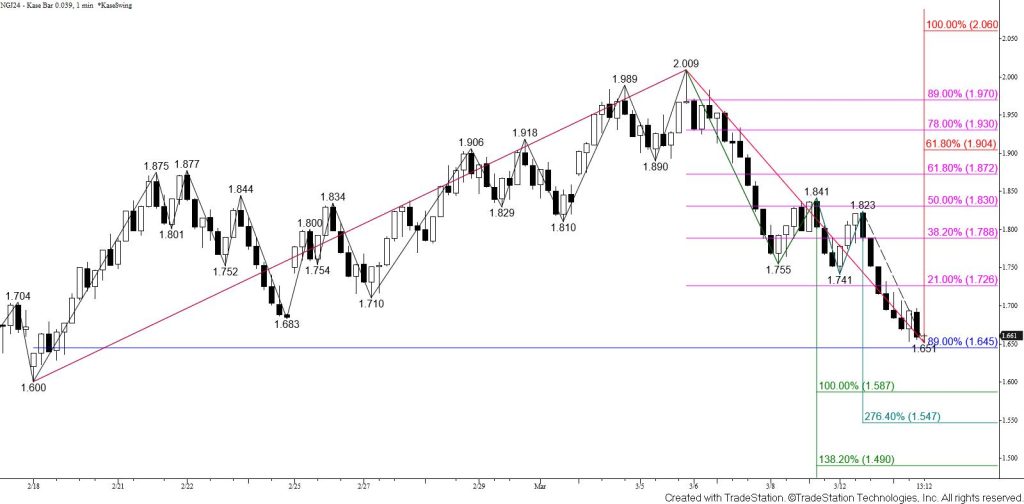

April natural gas took out the $1.683 swing low and invalidated the prior primary wave up from the $1.600 contract low today. This was bearish for the outlook in the coming days and provides more technical evidence that April will fall to a new contract low of at least $1.59. There is a minor target at $1.62, but the largest wave down from $2.009 favors a test of its $1.59 equal to (1.00) target. Settling below this will call for $1.55 and then the $1.49 intermediate (1.382) target of the wave down from $2.009. The $1.49 objective is most important because it is also the equal to target of the wave down from $3.325, the intermediate target of the wave down from $2.717, and is in line with the continuation chart’s $1.511 swing low.

There are no bullish patterns or signals that call for the move down to stall. Prices are trading back below all major daily moving averages and daily trend indicators are bearish again. The daily RSI and Stochastic are falling into oversold territory but can remain in that state for some time before prices turn higher. Nevertheless, should April fall to be new contract low there is potential for daily bullish KasePO, KaseCD, and MACD divergences. However, both price and momentum will need to form a swing low to confirm these signals.

Should prices turn higher before falling much lower look for initial resistance at $1.73. Overcoming this would call for a test of key near-term resistance at $1.79. This is the 38 percent retracement of the decline from $2.009. Settling above $1.79 would not mean that the move down has failed but would put near-term odds in favor of a larger test of resistance and warn that prices could begin to settle into a range.