Natural Gas Technical Analysis and Near-Term Outlook

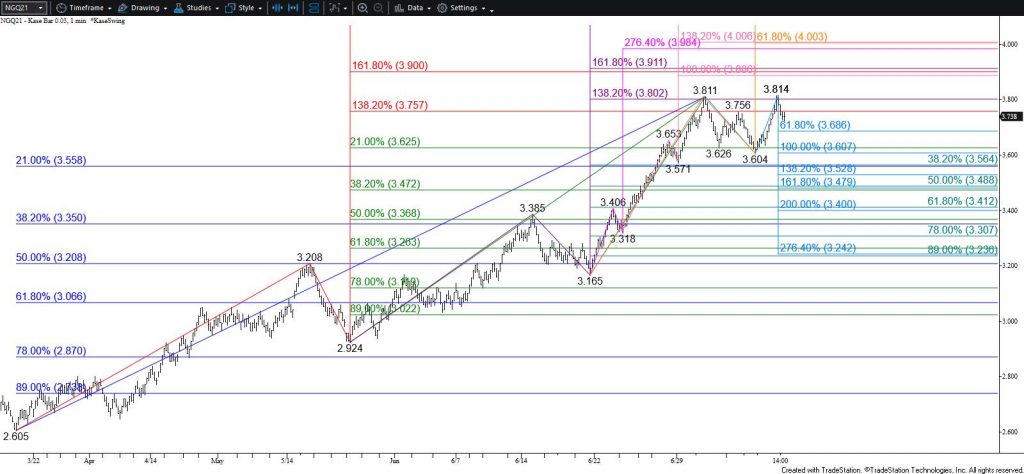

During the past few weeks natural gas has risen at a rate that is not sustainable. There is still risk for a move to challenge $3.90 and possibly $3.99, especially after this afternoon’s late rally to challenge $3.81 again. However, the move up will not likely last much longer and there is a potential double top that has formed at $3.81.

Tomorrow, look for a test of $3.69, a move below which will call for $3.60. This is the confirmation point of the double top. Settling below $3.60 will clear the way for an aggressive decline toward the pattern’s $3.40 target in the coming days.

With that said, should natural gas overcome $3.77 early tomorrow look for another test of $3.81. Rising above this will clear the way for $3.90 and possibly $3.99 during the next few days. At this point, there is no strong technical evidence to call for a move above $3.99.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.