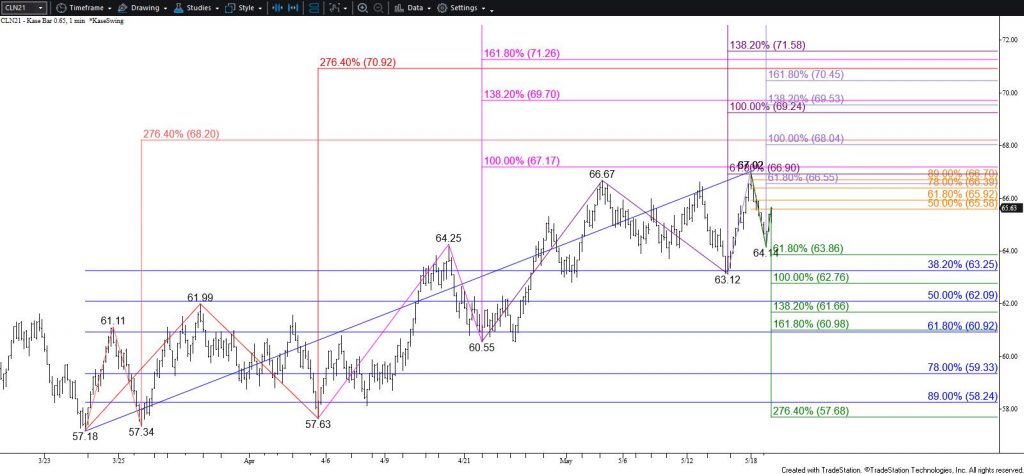

WTI Crude Oil Technical Analysis and Short-Term Forecast

WTI crude oil rose to $67.0 as called for today and negated the double and triple top patterns that formed around $66.65. Today’s move also fulfilled the $67.0 smaller than (0.618) target of the subwave up from $60.55. This and other subwaves up from $57.18 now call for an extension to at least $68.1 during the next few days. The connection to $68.1 is made through the $66.6 smaller than target of the wave up from $63.12, which projects to $68.1 as the equal to target.

Nevertheless, today’s pullback suggests the move up will remain a grind. Choppy trading conditions and wide swings are anticipated. Even so, should WTI take out $63.9 before reaching $66.6 look for a test of key near-term support at $62.9. Closing below this will call for a deeper test of support before the move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial