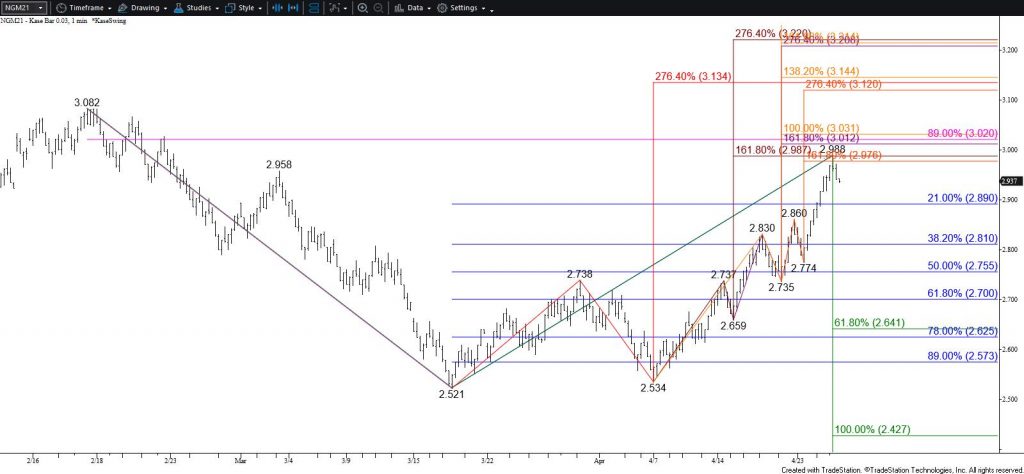

Natural Gas Technical Analysis and Near-Term Outlook

Natural gas has taken on a more bullish outlook during the past week. The primary subwave up from $2.534 settled above its $2.92 smaller than (0.618) target and favors a test of its $3.03 equal to (1.00) target. The move up is beginning to look exhausted though, so settling above $3.03 will likely be a challenge during the next few days. Even so, this would clear the way for $3.03 and possibly $3.13, which is the highest that the primary wave up from $2.521 projects.

With that said, the move up has stalled just below the psychologically important $3.00 level at $2.988 and formed a bearish shooting star today. Therefore, there is a good chance for a test of $2.91 first. This is Tuesday’s midpoint and the completion point of the shooting star. Closing below $2.91 will call for a test of the shooting star’s $2.87 confirmation point. Confirming the shooting star would call for a deeper test of support before rising to challenge targets around $3.00 again.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.