Natural Gas Technical Analysis and Near-Term Outlook

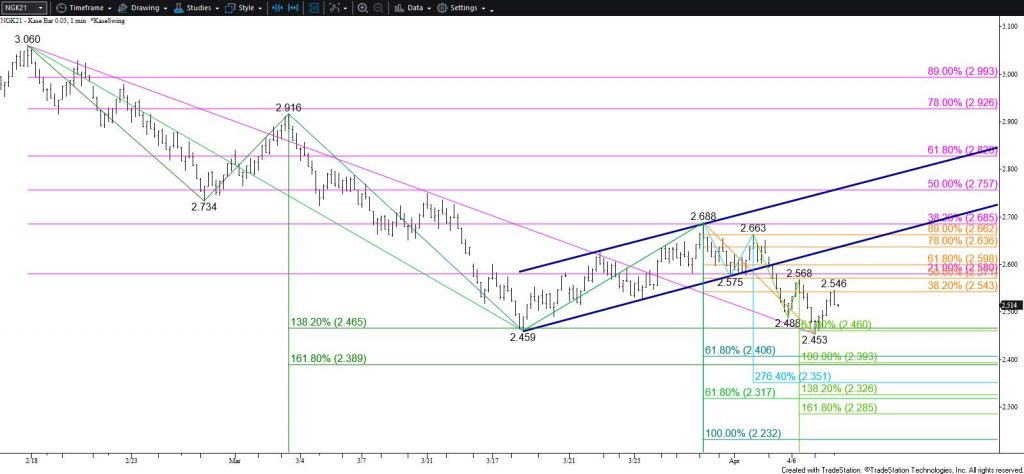

Natural gas retains a firm bearish outlook even after today’s somewhat surprising bounce. The move up stalled near the 38 percent retracement of the decline from $2.688 and could not overcome the $2.568 intra-day swing high. This suggests the move up is another correction after breaking lower out of the bearish flag pattern Monday. The move down is poised to challenge $2.46 again, a close below which will call for the next major objective and a potential stalling point at $2.40. Nevertheless, as stated in yesterday’s daily update, an eventual close below $2.40 is expected, which will clear the way for $2.33 and lower.

With that said, today’s move up dampens near-term odds for a continued decline during the next few days. Moreover, should natural gas overcome today’s $2.546 high early tomorrow look for a test of $2.59. This has become a highly confluent resistance level and is in line with the breakout point of the flag. It is common to see a pullback to challenge the breakout point of this type of pattern. Closing above $2.59 is doubtful, but such a move would reflect a bullish shift in near-term sentiment and call for $2.64 and possibly a move back toward crucial upper resistance at $2.69 again.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.