Natural Gas Near-Term Outlook

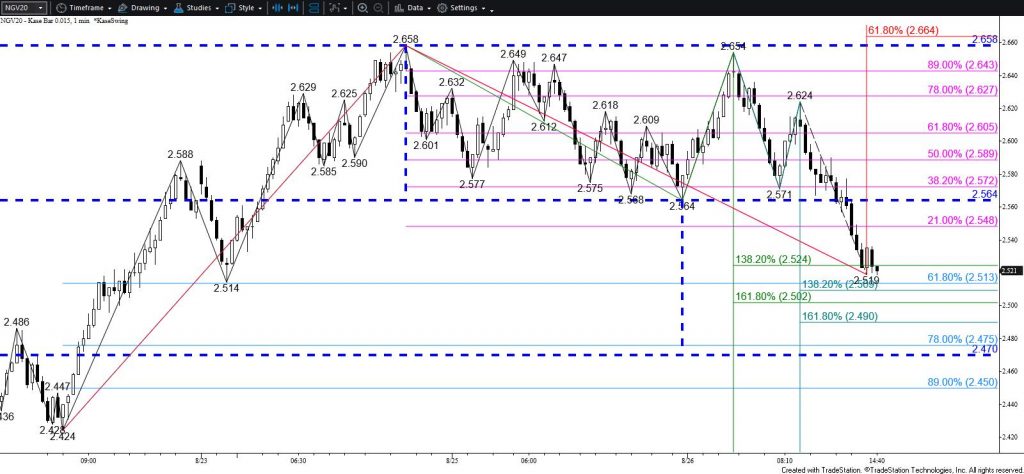

Tomorrow’s outlook for October natural gas leans negative after confirming an intra-day double top that formed between the $2.658 and $2.654 swing highs. The double top was confirmed by today’s close below the $2.564 swing low and the pattern’s target is $2.47. Double tops like this one meet their target 64 percent of the time.

The decline will not likely last much longer because the move down from $2.658 forms a corrective wave in a larger scale five-wave uptrend. There is also immediate support at $2.50 that may prove to be a stalling point early tomorrow. This is in line with the larger than (1.618) target of the primary wave down from $2.658 and the 62 percent retracement of the rise from $2.424. Therefore, closing below $2.47 is doubtful. However, this would clear the way for a larger correction to challenge $2.39 and possibly lower.

Once the $2.47 target is met odds for a continued rise will increase. However, should $2.50 hold, look for initial resistance at $2.57, and then $2.61. Settling above $2.61 would strongly imply that the correction is complete and clear the way for $2.67 and higher.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.