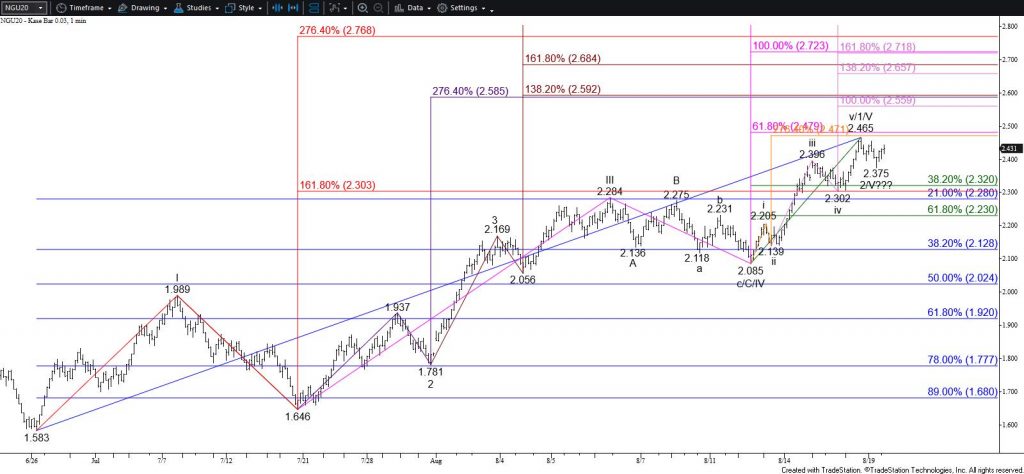

Natural Gas Near-Term Outlook

The outlook for natural gas remains bullish because September’s move up from $1.583 is unfolding as a textbook five-wave trend the targets $2.75. The more recent rise from $2.085 forms a likely Wave 1/V that has broken down into five sub-waves that stalled at $2.465 yesterday. The decline from $2.465 is corrective and probably forms Wave 2/V. Settling above $2.48 will indicate that Wave 3/V is underway and would call for $2.55 and higher.

Nevertheless, today’s hanging man and a confirmed daily bearish MACD divergence indicate a deeper test of support might take place first. Falling below $2.39 early tomorrow will call for $2.32. This level is expected to hold because it is the 38 percent retracement of the rise from $2.085. Settling below $2.32 will all for Wave 2/V to challenge $2.28 and possibly $2.23. For the five-wave trend to continue to unfold as expected $2.23 must hold.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.