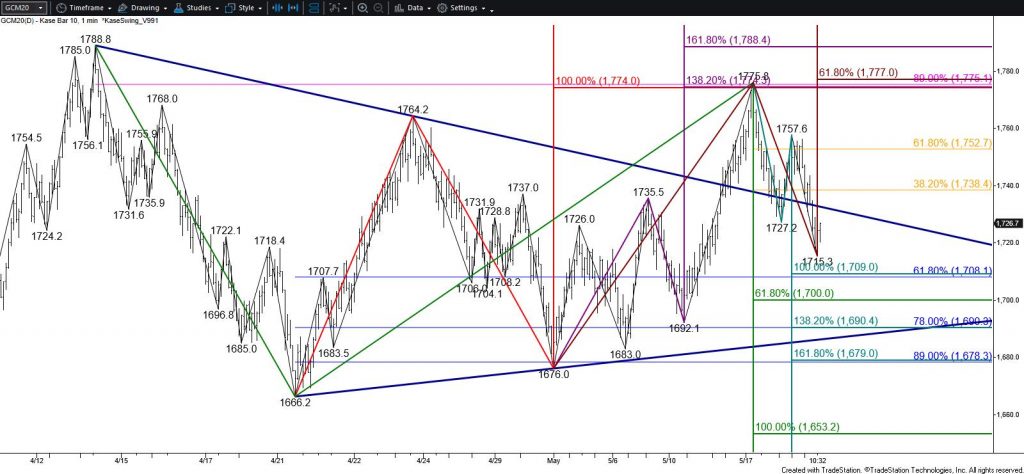

Gold Price Forecast

Gold fell below the upper trend line of the bullish coil that prices broke out of on May 14. The pullback from $1755.8 is most likely corrective but is poised to extend to $1704 ahead of the holiday weekend. This is in line with the equal to (1.00) target of the wave down from $1775.8, the smaller than (0.618) target of the primary wave down from $1788.8, and the 62 percent retracement of the move up from $1666.2.

The confluence and importance of targets around $1704 make it a decision point for a bearish near-term outlook. For the move up to continue during the next few days $1704 must hold.

Closing below $1704 will call for $1679 and likely $1653. Support at $1653 is expected to hold.

Should $1704 hold, look for initial resistance at $1738 and key near-term resistance at $1753. Settling above $1753 will shift near-term odds back in favor of $1777, which then connects to $1799 and the next major objective at $1821.

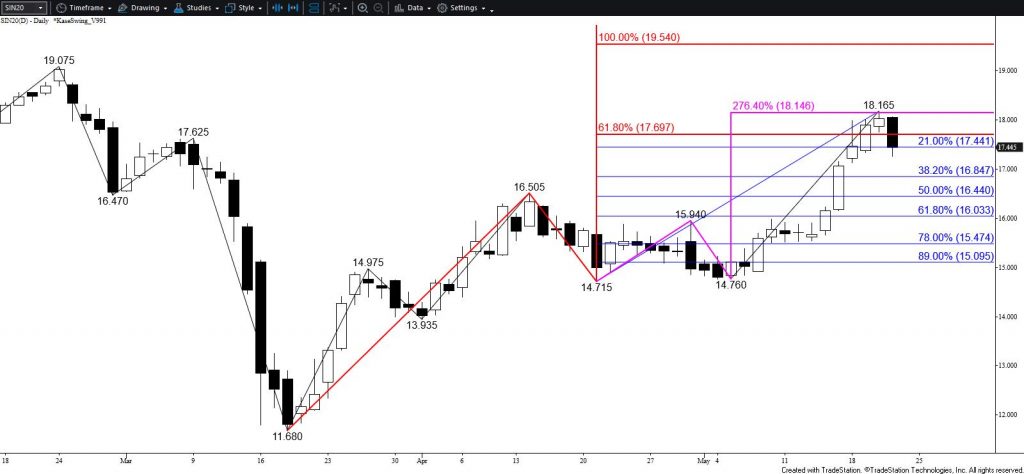

Silver Price Forecast

The long-term outlook for silver is bullish. However, the recent move up stalled at the XC (2.764) projection of the primary wave up from $14.715. This is the highest this wave projects. The subsequent move down formed a bearish engulfing line and confirmed an evening star today. This strongly implies that a deeper correction will take place during the next day or so before the move up continues.

Based on the intra-day waves down from $18.165, look for a test of at least $17.13 and possibly $16.91 before the move up continues. The $16.91 objective is split between the larger than (1.618) target of the primary wave down from $18.165 and the 38 percent retracement of the rise from $14.715. For the move up to continue during the next few days $16.91 must hold. Closing below this would call for $16.39 and possibly $16.03 before silver rallies again.

Should silver turn higher before taking out $17.13 support, look for initial resistance at $17.82 and key resistance at $18.08. Settling above $18.08 would shift near-term odds back in favor of rising toward the next major objective at $19.54 with interposed targets at $18.42 and $18.74.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ration, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.