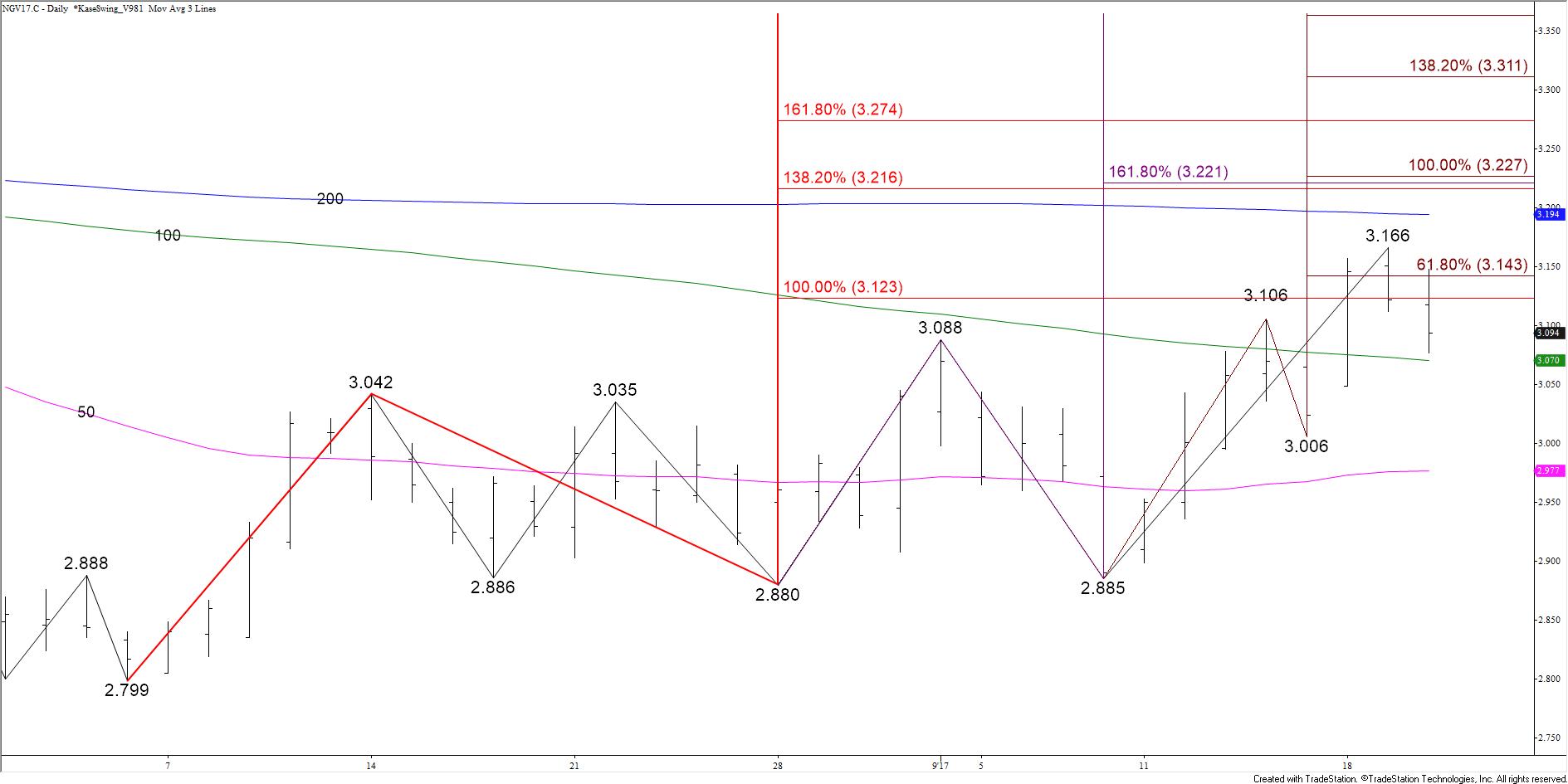

October natural gas’ settle below Monday’s $3.098 midpoint opens the way for a larger correction to at least $3.06. The move down is most likely corrective. However, for the move up to continue over the next few days $3.06 needs to hold. A close below this would not doom the move up but rather indicate that a deeper test of support and possible consolidation will begin to take place.

Initial resistance is $3.13, the 62 percent retracement of the decline from $3.166, so far. $3.17 is the key threshold for the near-term. A close above this would indicate the corrective pullback is over and that the move up will extend to $3.23. This is currently the most confluent objective making it another potential stalling point.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.