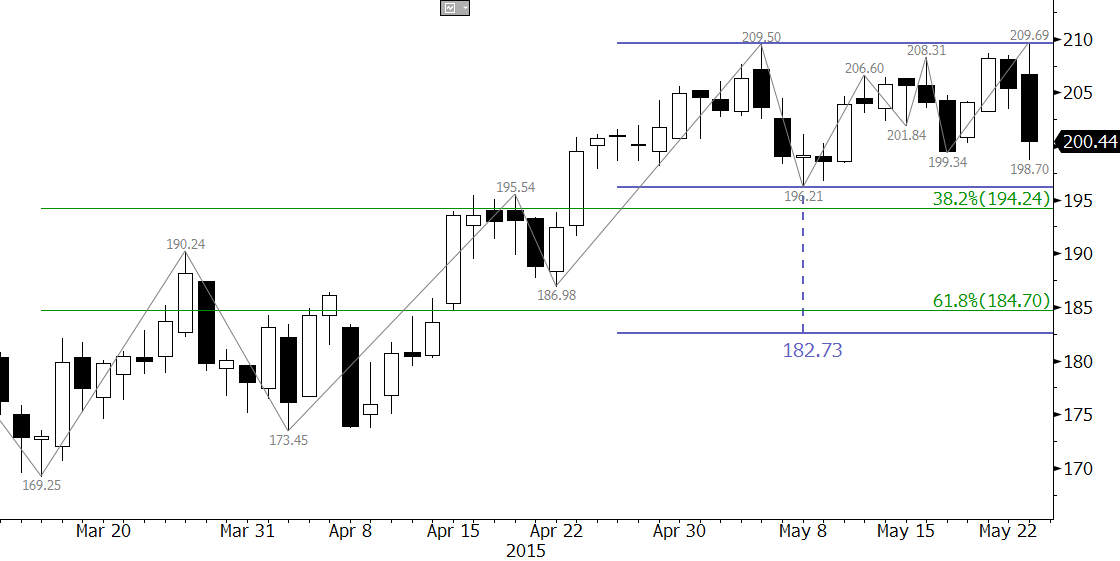

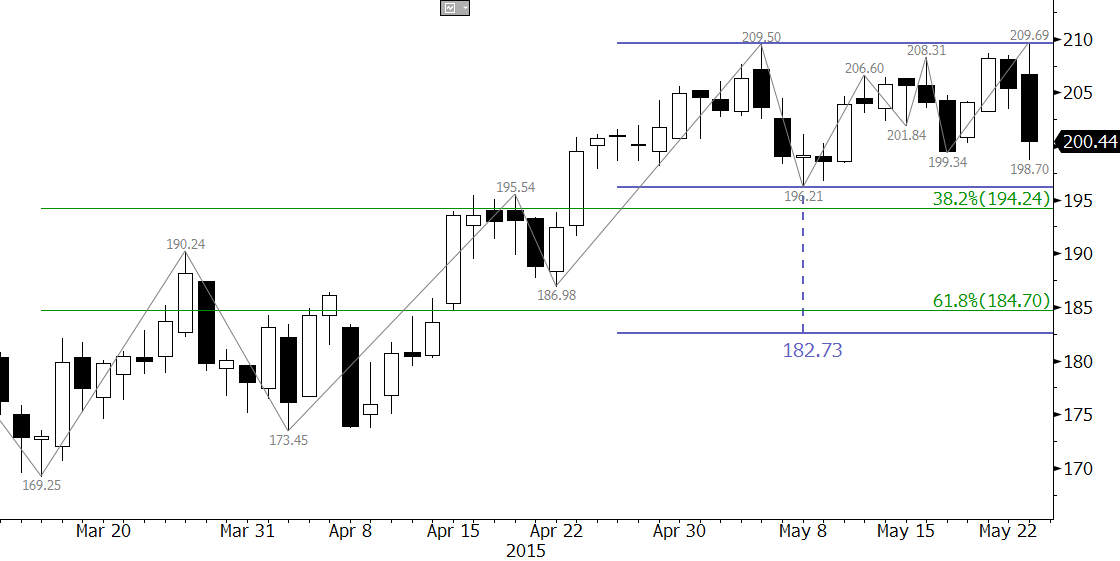

Gasoline futures formed a double top at approximately 209.5 after attempting to overcome this crucial area of resistance in early trading Tuesday. The double top and confirmed dark cloud cover call for at least 195.0. This is a crucial decision point for an extended correction because 195.0 is in line with the 196.21 swing low and 38 percent retracement from 169.25. A close below 195.0 will confirm the double top and open the way for its target near 183.7, which is also near the 62 percent retracement.

Take a trial of Kase’s weekly energy forecasts.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT

I believe that a ‘dark cloud’ candle should open above the prior up candles close and then close below the 50% mark of the up days candle. The pattern you refer to here is possibly a ‘3 inside down’ pattern – still bearish and confirms the bearish sentiment once it closes below the low of the first candle of the pattern – not always a good long term signal though (see Bulkowski’s work for specifics).

Thanks for the feedback Ben. Bulkowski’s work is a great resource, his Encyclopedia of Chart Patterns frequently comes down from my shelf just behind my desk. You are correct, the dark cloud should open above the prior up day’s close. In this case, the open is just below, so technically it is an inside day. The close below the midpoint is the key factor here, and as we have subsequently seen, the decline has followed through as called for. Yesterday’s close below 196.21 confirms the double top (not perfect either, but they rarely are), which opens the way for the 183.7 target discussed in the update.

I don’t think gas prices will fall apart here, and both WTI and Brent are up against major support right now. Therefore, this may not be a long-term decline, but much more so a consolidation of prices while the crude oil markets sort themselves out.